|

Number 675, 2003 by Georgia Economou |

FETA 2: The Feta Cheese Wars |

![]()

|

Number 675, 2003 by Georgia Economou |

FETA 2: The Feta Cheese Wars |

![]()

1.

The Issue

In a recent

European ruling, feta cheese was recognized by the European Community as a Greek

branded product under the Protected Designation of Origin (PDO) status. The

battle for feta has gone on for thirteen years because of challenges with other

European Union nations. Denmark, France, and Germany also produce cheese under

the name of feta. The new PDO ruling will benefit Greek farmers who had previously

faced market competition from these other nations. However, Denmark and France

are not willing to give up the battle as they continue to appeal this decision

to the European Court of Justice (ECJ), in hopes of reversing Greece’s

full rights over feta cheese. In this case study, the research examines the

challenges in the “feta wars” and how this issue relates to European

Union decisions, globalization, international trade, and culture.

2. Description

The Sequence of

Events that has led to the PDO Status of feta cheese: 1. In

1994, Greece asked for feta to be protected under a PDO status and was accepted

by the European Commission in 1996. However, this decision was met by disapproval

from Denmark, Germany, and France who contest that feta is a generic term like

cheddar and camembert cheeses. 2. On

March 16, 1999, the ECJ reversed the decision of feta as a cheese of unique

Greek origin because of the challenge from these other European Union nations

who also produced “feta.” In order to try to settle this controversial

issue the Commission conducted a survey in all EU nations to determine the association

with the term “feta,” whether Greek or not? The Greek ministry of

dairy products then began to prepare research and evidence of Greek origin to

defend their position. 3. On

July 27, 2002, after this evidence had been submitted, the EU agricultural ministers

voted on the feta issue, but the ruling was not given to Greece. The Commission

then took control of these matters and determined that in September PDO would

be granted to Greece. 4. On

October 14, 2002 it was officially decided that feta cheese is a Greek product,

which can be produced only in certain parts of Greece with specified regulations.

Other nations were given five years to change the name of their “feta”

cheese or stop production. Origins of Production: Amount

of Feta Production for Certain Countries(tons per year):

This case study will examine

the issues having to do with the fight over feta cheese intellectual property

rights of PDO status within the European Union. These issues include: the feta

cheese origination in Greece as compared to other European nations who contest

to the latest ruling, what this ruling means for European farmers, and an overall

look at the way globalization effects different nations, who in pursuit of cooperative

benefits run into snags along the way. In

order to understand this case study, it is important to take into account the

importance of a PDO status. A PDO status offers a country with a unique product

the ability to establish its quality within the market and halt the competition

of imitation products, from gaining consumer sales. The PDO status began in

the EU in 1992, as a way to protect specific foods and maintain their authenticity.

The

main debate at hand is the symbolic nature of feta cheese. Whether “feta”

is a generic term or unique to Greek origin? The production of feta cheese in

Greece has roots of 6,000 years. Feta production has been linked with Greek

history and literature since ancient times. Denmark has made feta since 1963,

the Netherlands since 1981, and Germany since 1985. Denmark, Germany, and France

also produce large amounts of “feta” for export purposes. This in

turn has created the battle over feta rights.

The

main debate at hand is the symbolic nature of feta cheese. Whether “feta”

is a generic term or unique to Greek origin? The production of feta cheese in

Greece has roots of 6,000 years. Feta production has been linked with Greek

history and literature since ancient times. Denmark has made feta since 1963,

the Netherlands since 1981, and Germany since 1985. Denmark, Germany, and France

also produce large amounts of “feta” for export purposes. This in

turn has created the battle over feta rights.

The implications of this decision has caused trouble for certain farmers. After

the feta PDO decision, 4,000 to 5,000 French farmers demonstrated against this

ruling under the Federation of Unions of Ewe Farmers. The sheep farmers in France

produce 12,000 tons of feta a year. Their production and sales are threatened

by the PDO specialized status of Greek feta. Greece produces 115,000 tons of

feta each year, and most of this is sold domestically. This shows how specific

this cheese is to Greek traditional food. The largest percentage of feta consumption

is in Greece (85.6%). Denmark produces 27,640 tons a year, Germany makes 20,000

to 40,000 tons a year, and France makes 8,000 to 20,000 tons a year. Other nations

began their production of feta in order to appeal to their Greek immigrant market.

As feta cheese's popularity grew production spread to many other EU countries.

The Greek-Feta Argument:

Greece

has placed quality regulations on the production of their feta since 1935. Denmark

did not regulate feta until 1963, and these regulations differ in comparison

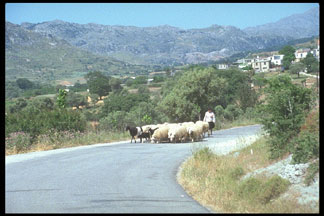

to Greek production methods. Greek feta production is restricted to primarily

sheep milk and some goat milk, while other countries use cow milk in the process.

These countries also use coloring agents to change the yellowish tint produced

from cow’s milk to a pure whiter form of goat and sheep milk. The subsistence

of these goat and sheep is specific to the dry climatic conditions of certain

regions in Greece, where particular graze feeds these animals. The methods of

production are also unique to Greece. In a report, it was found that most of

feta marketing uses the image of Greek origin, such as the Greek flag, to sell

their product.

Greece

has placed quality regulations on the production of their feta since 1935. Denmark

did not regulate feta until 1963, and these regulations differ in comparison

to Greek production methods. Greek feta production is restricted to primarily

sheep milk and some goat milk, while other countries use cow milk in the process.

These countries also use coloring agents to change the yellowish tint produced

from cow’s milk to a pure whiter form of goat and sheep milk. The subsistence

of these goat and sheep is specific to the dry climatic conditions of certain

regions in Greece, where particular graze feeds these animals. The methods of

production are also unique to Greece. In a report, it was found that most of

feta marketing uses the image of Greek origin, such as the Greek flag, to sell

their product.

The Generic Feta Argument:

Denmark, Germany, and France argued that feta is a generic term of cheese, which

is not unique to Greek production. After the decision granting Greece PDO rights,

Denmark and France will continue to fight for their own feta rights.

The Effects of Globalization: €

The European Union has created common policy and currency for advantageous cooperation.

While this Union has been prosperous for regional advantages, it has also taken

a toll on the adjustment of unique European nation-states towards the conglomeration

of Europe as a whole. The "feta wars" are an example of a nation trying

to preserve the origin of a certain product. The overall symbolism of this case

study is the effect of a globalizing market versus country specific culture and

origin. Just as so many other products have been unique to specific regions in

certain nations, so too is the product of feta to Greece.

The European Union has created common policy and currency for advantageous cooperation.

While this Union has been prosperous for regional advantages, it has also taken

a toll on the adjustment of unique European nation-states towards the conglomeration

of Europe as a whole. The "feta wars" are an example of a nation trying

to preserve the origin of a certain product. The overall symbolism of this case

study is the effect of a globalizing market versus country specific culture and

origin. Just as so many other products have been unique to specific regions in

certain nations, so too is the product of feta to Greece.

3. Related Cases

In analyzing the relationship between the feta case study and other case studies on the Trade and Environment Database (TED) the results showed connecting links of other products also competing for status in cultural terms. When searching related cases through the TED search engines the first free-text search was done by choosing “Intellectual Property.” This inquiry received ten matches. These include: bacardi, biodiv, brazil-aids, grappa, havens, merck, mummy, neemtree, saudpork, and tequila. Of these cases, the only ones that are directly related to the feta case study are tequila, grappa, and neemtree. Tequila and grappa are two drinks that are made in particular regions, where the intellectual property rights are being disputed in much the same way as feta. These unique products are being met by opposition from countries who produce imitations and market them under the same name as the real thing.

Intellectual property is a very important issue with these food and beverage products because not only are the imitations being sold under the pretense of the real thing, but this also disrupts the quality of these unique products. Neemtree is a case study that has to do with the protection of an indigenous tree under controversy between two nations (United States and India). Although this case is similar to the feta issue, in that it is being disputed on the subject of origin, it also differs because it is an issue of biopiracy and not agricultural piracy. In repeating this search for intellectual property and also food, grappa showed up as a single finding. Grappa is explained below.

In the second categorical search, using food and intellectual property as guiding

terms, the results found eleven matches. These include: bacardi, basmati, budweis,

canola, grappa, mexbrew, pisco, scotch, tequila, wine-pact, and zinfandel. Basmati,

budweis, grappa, scotch, tequila, and zinfandel are the cases directly related

to feta. All these cases consist of either food or drink, which are made in

a country specific regions with the intellectual property rights in dispute.

The third search on the TED Expert Sorts revealed the following top ten findings,

budwies (67%), grappa (56%), Irishmusic (56%), scotch (56%), maize (44%), milk

(44%), sturgeon (44%), canola (44%), Danish (44%), and Italybag (44%). However,

only two of these findings directly relate to the feta case study. These are

grappa and scotch which have to do with unique status disputes and intellectual

property rights.

Top Ten Search Results Related to the Feta Case Study:

SEARCH NUMBER-

| 1 |

2 |

3 |

| Budwies* |

||

| Basmati* |

Grappa* |

|

| Budweis* |

||

| Grappa* |

Scotch* |

|

| Grappa* |

||

| Scotch* |

||

| Tequila* |

||

| Tequila* |

*= relevance to feta case study

Overall, the cases which are similar to the feta case study are ones in which a product is being disputed over intellectual property rights. Tequila, grappa, basmati, budwies, and scotch are the best matches with the feta case study. The reason for this is that these products are either in a dispute or have been over intellectual property rights by an opposing party. Some of these products have been granted some specialized status which protects their production from being imitated, and others are in the process of gaining these rights. Feta has recently gained its protection status under Protected Designation of Origin from the European Court of Justice.

Tequila-

Although Mexico has won protection rights of this drink as a geographically

indicated product under NAFTA, the issue has re-emerged with the EU and China

as Mexico tries to join the WTO. This case study relates to the feta case in

that intellectual property rights law is the primary issue in debate as a second

round continues. Feta was not granted the PDO status until the recent rounds

of the EU, but in much the same way has been a re-emergent issue, while under

the appeal of Denmark, France, and Germany.

Grappa- This case study is a controversy between the EU and South Africa. South Africa has been called to stop using the name grappa within a five year period. Much like other nations have had to stop using the term feta in the same period of time. This case study also shows the importance of intellectual property rights within the EU.

Basmati-

The US was granted a patent to distribute “Basmati” rice,

however this rice is indigenous to India and Pakistan. This is another case

study showing the effects of intellectual property rights in the market. If

the US continues to sell this rice under the unique name of Basmati, it will

greatly slow the markets of India and Pakistan. This relates to the feta case,

where Greece had to compete with Denmark, France, and Germany and other countries

who produce feta in the global market.

Budweis-

This is a dispute over the label Budweiser for beer in the United States

and the Czech Republic. Both these countries have had histories in the production

of beer under this name and so the issue had been brought to the attention of

the courts. The outcome was that neither country won, and instead the market

divided. This relates to feta because this issue was also taken to courts in

order to find a solution, and yet the outcome still remains controversial.

Scotch-Scotch

whiskey is protected from other nations imitating the product from Scotland.

This product's status was also settled in the EU, like this case study.

Other important case studies include Feta 1 and Parmesan. These case studies are directly related to this case study because they also have to do with the status of cheese in global trade.

4. Author and Date:

Georgia Economou

May 7, 2003

The current issue of feta as Protected Designation of Origin (PDO) status for

the EU is very much related

to the legal matters of the World Trade Organization. The PDO status of the

European Union is named Geographical Indication (GI) under the WTO. Feta cheese

is under the protection of both PDO and GI status as ruled by the European Court

of Justice. This is important to the intellectual property matters of the WTO,

especially to those related to the Agreement on Trade Related Intellectual Property

(TRIP). When the ECJ decided to grant the special protected status to feta cheese,

this was not only under EU law but also WTO rules, as both abide by ECJ decisions.

TRIPs Agreement:

The TRIPs agreement of 1996 outlines the conditions of the GI status. Geographical

Indications are defined in this agreement as “indications which identify

a good as originating in the territory of a Member, or a region or locality

in that territory, where a given quality, reputation or other characteristic

of the good is essentially attributable to its geographical origin.” This

status is a protection that is given to goods, which are unique to a certain

region of a country. There are two levels of protection under the GI status,

one for wines and spirits and one for products that are not wines or spirits

(including cheese). Feta cheese is under this kind of protection, just as champagne,

scotch whiskey, and roquefort. The GI rules are safeguarded in Article 22 of

the TRIPs Agreement, which protect quality control for consumers and against

unfair competition for producers. In order to gain this status a demonstration

of a quality product from a certain place or origin must be presented.

Consumers Versus

Producers:

GI status is important for both consumers and producers. Consumers are guaranteed

the quality under this status. “EU consumers highly appreciate GIs as

demonstrated by a 1999 consumers survey indicating that, generally, 40% of consumers

are ready to pay a 10% premium price for origin-guaranteed products. Allowing

non-Greek cheeses to be labeled as ‘feta’ can hardly be accepted

when according to a market survey 79% of EU consumers believe that ‘feta’

evokes an origin rather than a type of product.” This means that when

people think of feta, they regard it as Greek. GI status also helps to ensure

the rights of the producers who will not have to compete to sell their product

at a global level. Other producers of imitation feta are prohibited from using

the same name to sell their good.

Historically, other international treaties tried to incorporate Geographical Indications as part of their protections. One of these was the Paris Convention for the Protection of Industrial Property of 1883. This agreement prohibited any false advertisement for a good indicating source of origin. The Madrid Agreement of 1891 worked in very much the same way as the previous. The Lisbon Agreement of 1958 included a registration for the protection of origin for member countries. However, these agreements were not very successful because they did not provide adequate protection over products or against unfair competition. The TRIPS Agreement has allowed for countries to register their products with great effectiveness.

Countries that are members of the WTO (over 130 countries) must change their

laws to fit the intellectual property rules of the TRIPs Agreement. All members

must follow the Geographical Indication rules as defined in the TRIPS Agreement

Article 22 which states, “members shall provide the legal means for interested

parties to prevent…the use of any means… which misleads the public

as to the geographical origin of the good... or any use which constitutes an

act of unfair competition…”

Countries which produce imitation products, stand to lose money if they have to change the name and the marketing of their product. These countries are concerned with this specialized status. Denmark, for example, which stands to lose from the decision granting full rights to Greece for feta, argues that this cheese should be used as a generic name and not registered to a certain region of Greece. Denmark is in the process of appealing the ECJ decision once again, saying that feta is a generic term and not unique to the origins of Greece. The point is that there will never be full satisfaction of any kind of protected origin status because some countries will always be at a disadvantage. The decision to grant certain products with unique quality and connection to a certain region of a country is not a new decision however, its organization and registration within the WTO and EU is fairly new and faces opposition by those in a disadvantaged position.

5. Discourse and Status: Disagreement and in progress

6. Forum and Scope: European Union and Regional

7. Decision Breadth: 15

8. Legal Standing: Treaty

9. Geographic Locations

a. Geographic Domain:

Europe

b. Geographic Site:

Europe

c. Geographic Impact:

Europe

10. Sub-National

Factors: No

11. Type of Habitat:

Temperate

Food and Agricultural

Industrial Sectors III.

Geographic Clusters

IV.

Trade Clusters

Greece

was recently granted Protected Designation of Origin (PDO) status for feta cheese.

This decision by the European Union has been opposed by some other member states,

which also produce feta at large quantities for export sales. These other countries

have a time limit of five years to rename their product or stop production.

This new status decision gave Greece complete rights over feta because it is

specifically produced in a special way in certain regions of Greece. The competition

of feta cheese from other countries will soon disappear. However, certain nations

are not yet willing to give up the fight because they stand to lose a great

deal of money from this decision.

Greece

was recently granted Protected Designation of Origin (PDO) status for feta cheese.

This decision by the European Union has been opposed by some other member states,

which also produce feta at large quantities for export sales. These other countries

have a time limit of five years to rename their product or stop production.

This new status decision gave Greece complete rights over feta because it is

specifically produced in a special way in certain regions of Greece. The competition

of feta cheese from other countries will soon disappear. However, certain nations

are not yet willing to give up the fight because they stand to lose a great

deal of money from this decision.

The ITC Database for International

Trade Statistics from the WTO and UNCTAD report the value of US dollars made

in the production of cheese and curd. The value in exports for cheese and curd

production in Greece during the year 2000 is 82.9 million dollars. The value

of imports for cheese and curd production in Greece during the same year is

211.9 million dollars. This data shows how most of the cheese production in

Greece is used for domestic consumption. It is a known fact that Greece and

France are the two leading countries in per capita cheese consumption, meaning

an average consumption of over 50 pounds of cheese annually for members of these

countries.

The Value of Exports and Imports of Cheese and Curd

Production in Greece During the Year 2000:

| Exports | $82.9

million |

| Imports | $211.9 million |

Other

countries use cow’s milk in the process of feta production. Greek regulations

ensure that feta is made primarily from sheep’s milk, with some goat’s

milk. In 2001, only three EU countries compose 97% of the production of goat’s

milk including Greece, Spain, and France. These statistics indicate that Greece

is one of the largest goat milk producers, which is a main component in the

regulation of feta cheese production. Other countries use cow’s milk because

they do not have the same resources as Greece. Using cow’s milk in feta

production makes its color yellowish, which then has to be artificially dyed

in order to get the pure white feta color, which is natural to Greek feta.

Other

countries use cow’s milk in the process of feta production. Greek regulations

ensure that feta is made primarily from sheep’s milk, with some goat’s

milk. In 2001, only three EU countries compose 97% of the production of goat’s

milk including Greece, Spain, and France. These statistics indicate that Greece

is one of the largest goat milk producers, which is a main component in the

regulation of feta cheese production. Other countries use cow’s milk because

they do not have the same resources as Greece. Using cow’s milk in feta

production makes its color yellowish, which then has to be artificially dyed

in order to get the pure white feta color, which is natural to Greek feta.

Greece produced 9 million tons of cheese in 2001. The consumption of cheese

was 25 kg. per capita annually, making Greece one of the leading cheese consuming

countries. Greece imported 71 million tons of cheese, and exported 20 million

tons of cheese in 2001. These figures show the importance of cheese to Greek

domestic consumption. Also, with the new PDO status there is more opportunity

in the market for the export growth of Greek feta.

Feta cheese production is mainly important to four European Union members. These are Greece, Denmark, France, and Germany. The United Kingdom, Italy, Finland, Austria, Belgium, Sweden, Ireland, the Netherlands, and Spain also produce feta cheese but its new status does not significantly concern these other EU nations.

Country Specific Feta Cheese Origin, Composition, and Production:

| NATION: |

ORIGIN

OF PRODUCTION: |

COMPOSITION

OF FETA: |

AMOUNT

OF PRODUCTION (tons per year): |

| Greece |

Ancient

Times |

Primarily

sheep's milk, with a 30% limit of goat's milk |

115,000 |

| Denmark |

1930 |

Primarily

cow's milk |

27,640

|

| France |

1931 |

cow's

and goat's milk |

8,000-20,000 |

| Germany |

1972 |

Primarily

cow's milk |

20,000-40,000 |

Denmark

began to produce feta in the 1930’s, mostly for export purposes. Danish

feta is produced almost purely from cow’s milk. Denmark produces 27,640

tones of feta per year. France

produced feta since 1931, where it began in order to market to Armenian and

Greek immigrant consumers. Today, 77.5% of French feta is sold as an export.

French feta is produced with both goat’s and cow’s milk. France

produces 8,000 to 20,000 tones per year. German feta production began in 1972,

and was also originally produced for immigrant consumption. However, the German

feta market grew to include exports to Balkan and Middle Eastern countries,

as well as other EU member nations. Germany uses almost solely cow’s milk

for feta production. It produces 20,000 to 40,000 tons of feta per year.

Denmark

began to produce feta in the 1930’s, mostly for export purposes. Danish

feta is produced almost purely from cow’s milk. Denmark produces 27,640

tones of feta per year. France

produced feta since 1931, where it began in order to market to Armenian and

Greek immigrant consumers. Today, 77.5% of French feta is sold as an export.

French feta is produced with both goat’s and cow’s milk. France

produces 8,000 to 20,000 tones per year. German feta production began in 1972,

and was also originally produced for immigrant consumption. However, the German

feta market grew to include exports to Balkan and Middle Eastern countries,

as well as other EU member nations. Germany uses almost solely cow’s milk

for feta production. It produces 20,000 to 40,000 tons of feta per year.

Greece is responsible for 73% of the EU member country consumption of feta cheese.

Greece is the largest producer of feta with 115,000 tons annually, but it is

mostly used for domestic consumption. However, three-fourths of feta production

takes place outside of Greece and for export purposes. This is why this is such

a hot battle and still under appeal from Denmark, France, and Germany. These

other feta producing nations will be affected economically in their exportation

of feta. Jobs will be lost if the name is not changed. Even if the name ‘feta’

is changed, most likely marketing and sales will go down because it will be

under a new unknown name.

Cheese Production for Certain European Countries:

Country- |

Cheese

Production (tons per year)- |

| France |

1.6

million |

| Germany |

1

million |

| Denmark |

285

thousand |

| Greece |

190

thousand |

France is the largest producer of cheese in the EU (1.6 million metric tons per year), and second is Germany (1 million metric tons per year). Denmark is the seventh largest cheese producer (285 thousand metric tons per year), and Greece is the eighth largest cheese producer in the EU (190 thousand metric tons per year). This shows that even before the PDO decision favoring Greek feta, Greece was battling for feta rights with three countries which already had an advantage in the cheese industry of Europe, especially in exports.

Cheese Consumption for Certain European Countries:

Country- |

Cheese

Consumption (tons per year)- |

| France |

1.27

million |

| Germany |

1.01

million |

| Greece |

250

thousand |

| Denmark |

101

thousand |

France’s cheese consumption is 1.27 million tons annually, Germany’s cheese consumption is 1.01 million tons annually, Greece’s cheese consumption is 250 thousand tons annually, and Denmark’s cheese consumption is 101 thousand tons annually. Denmark produces almost double the amount of cheese as Greece, but Greece consumes more than double the amount of cheese as Denmark.

Cheese Imports and Exports for Certain Countries

(1,000 metric tons per year):

| Country: |

Imports: |

Exports: |

| Greece |

5 |

3 |

| Denmark |

1 |

50 |

| Germany |

23 |

120 |

| France |

15 |

100 |

This chart shows that France, Germany, and Denmark all produce cheese mostly for exports, where it is evident that Greece produces cheese for domestic consumption. This data illustrates the importance of cheese to the Greek culture and how relevant it is to Greek feta as a PDO. Feta is the epitome of Greek cheese, symbolic to the culture and traditions of Greece.

Another country which intends to fight for its right to feta, is Cyprus. This

country will try to keep the feta name but if worse comes to worse they will

try to rename their product “fetta.” However, Cyprus is not one

of the countries in main opposition to the PDO decision. Denmark, Germany, and

France have more to lose in their export market.

12. Type of Measure: Intellectual Property

13. Direct v. Indirect Impacts: Direct Impact

14. Relation of Trade Measure to Environmental Impact:

Directly Related to Product because it could relate to the export of goat or sheep’s milk. Related to agriculture and intellectual property.

15. Trade Product Identification: Feta Cheese

16. Economic Data: Qualitative Data

17. Impact of Trade Restriction: Medium

18. Industry Sector: Agriculture

19. Exporters and Importers: Greece and Many

Greece is both but primarily an importer of feta. Other countries are mainly exporters of feta.

20. Environmental

Problem Type: Cultural

The environmental

concern that has to do with the PDO status of feta cheese is the cultural aspects

of this product to Greece. Feta cheese is a symbol of Greek cuisine globally.

In the US, a Greek salad is not complete without feta cheese. It is a product

that is natural to Greek culture. Feta cheese is a primary food in the Greek

diet.

The environmental

concern that has to do with the PDO status of feta cheese is the cultural aspects

of this product to Greece. Feta cheese is a symbol of Greek cuisine globally.

In the US, a Greek salad is not complete without feta cheese. It is a product

that is natural to Greek culture. Feta cheese is a primary food in the Greek

diet.

Feta is one of the oldest cheeses in the world. It was developed in Greece thousands

of years ago in the Homeric age. Until 1898 it was produced for domestic consumption,

then it was commercialized using preservatives. In Greece it is made primarily

of sheep’s milk with an allowance of up to 30% goat’s milk. Its

production is also limited to the areas of Macedonia, Thrace, Epiros, Sterea

Hellas, Peloponese, and the island of Lesvos. These areas have a history of

herding cultures, which is why feta production originated in these regions.

The production of feta is allowed in only mountainous regions, where fertilizers

are not used. This preserves its organic maintenance. Feta production is limited

to sheep and goat milk because of the strong salty taste this milk will guarantee.

Other cultures, which make feta using cow’s milk, create a mild flavored

cheese. Greek feta is ripened and kept in brine for two months. There is great

strategy and process when it comes to feta production for the Greeks.

What

makes feta cheese so personable to the Greek culture has to do not only with

history but also with the daily lives of Greeks. Feta cheese is a primary food

in Greece. It is eaten at all times of the day, and a meal is not complete without

its presence on the table. It is eaten alone, with bread and olives, in salad,

with all types of entrée dishes, or as mezze with wine or ouzo. Greece

is the highest consumer of cheese in Europe. An average person eats 23 kg. per

year and 40% of this is feta cheese. Imagining Greece without feta cheese is

like imagining a Greece without the Parthenon.

What

makes feta cheese so personable to the Greek culture has to do not only with

history but also with the daily lives of Greeks. Feta cheese is a primary food

in Greece. It is eaten at all times of the day, and a meal is not complete without

its presence on the table. It is eaten alone, with bread and olives, in salad,

with all types of entrée dishes, or as mezze with wine or ouzo. Greece

is the highest consumer of cheese in Europe. An average person eats 23 kg. per

year and 40% of this is feta cheese. Imagining Greece without feta cheese is

like imagining a Greece without the Parthenon.

As someone with a Greek background, I cannot begin to stress the importance

of feta to our culture. Trying very hard not to go “My Big Fat Greek Wedding”

on people, feta is as Greek as the Acropolis or mythology. Even though I was

born in the US and am accustomed to American culture, my Greek culture is also

a large part of my life. In terms of food, feta is always a part of family meals-

breakfast, lunch, and dinner. You have to love feta if you’re Greek- no

doubt if you don’t the problems you will have. It is such a popular product

that other nations began to produce feta in order to get into the game.

Now that this product has achieved a PDO status it has opened an entirely new

market for Greek farmers. Most of the production of this product was used for

domestic consumption, but now the “real deal” will be available

globally. In what is left of a five-year period, other producers of feta will

have to give up the name to Greek producers who will ensure its quality. The

breakdown of the feta that is exported from Greece is as follows: 50% is sold

in Germany, 10% in the US, 9% in Italy, 5.5% in the UK, 5% in Australia, and

the remaining 20% to other European nations. These figures will increase as

feta cheese becomes limited to Greek production.

Mini Case Study:

George Giannakis is a Greek farmer who lives on the island of Lesvos. He raises

sheep and sells them in the market and to other farmers. His specialty is feta

production from Sheep's milk. However, until recently his product was not able

to compete in the global market. Other European nations were selling their feta

as Greek, when in reality it was not Greek. Now that PDO status has been won

for Greek feta cheese he will be able to sell his feta, the "real deal,"

in the European market and not have to compete with imitation feta.

21. Name, Type, and Diversity of Species

Name: goat and sheep which graze in specific regions of Greece

Type: certain regions of Greece including: Macedonia, Thrace, Epiros, Sterea Hellas, Peloponese, and the island of Lesvos

Diversity:

22. Resource Impact and Effect: High and products

23. Urgency and Lifetime: Low and thousands of years

24.

Substitutes: Imitation

products

Greek feta cheese

has gained PDO status and in a five-year period will be limited to only Greek

production. Other companies will have to change the name or halt production.

This will open up the markets for an increase in exports of feta from Greece.

25. Culture:

Yes

26. Trans-Boundary

Issues: No

27. Rights:

YesVI. Other

Factors

Relevant Literature :

European Union: Trade- Intellectual Property.

European Union: Agriculture and Food- Quality Policy.

Ministry of Foreign Affairs and Trade: WTO Negotiations: Negotiations on Intellectual Property Issues.

CIPR Activities- Geographical Indications.

IDFA New Center: "EU Decides that Feta Cheese Must Be Greek" Oct. 28, 2002.

Greece Now- The Real Thing: "The European Commission to Add Greek Feta Cheese to its List of Protected Products"

USDA Statistics: Cheese Production

Greekproducts.com: About Feta Cheese

Capra: Greece and the Goats

Wisconsin Specialty Cheese Institute: About Specialty Cheese. 2002.

HSBC Trade Services: "EU Says Feta Must Come From Greece, Cheesing off Denmark" by Mathew Newman

BBC News: "Europe Bans Non-Greek Feta Cheese"

Graphics:

5/2003