|

|

|

|

|

|

|

|

|

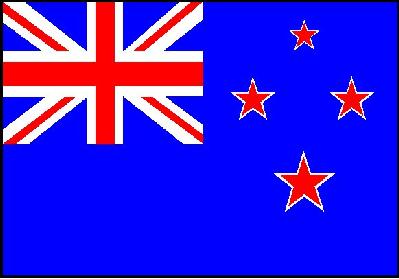

I. Identification

I. Identification

1. The Issue

Kiwi has three meanings: kiwi bird, kiwifruit, and New Zealand people. We can notice easily how special kiwi is to New Zealanders. This year, 2004, is hundredth year that the seed of kiwifruit crossed Pacific from China to New Zealand. However, New Zealand has not been any more the biggest kiwifruit production country since the early 1990s. At the same time, agricultural market is opening in the global context. Good quality and proper price are important problems both, export country and import country, are faced with. Let's take a look at the NZ's kiwifruit industry in a historical aspect, and estimate the possibility of Kiwifruit intellectial property and the prospect of NZ kiwifruit industry with a powerbrand "Zespri" at the head.

2. Description

The History

While New Zealand was one of the first countries to export kiwifruit, the history of the kiwifruit began in China. It was called "Yang Tao." In 1904 Isabel Fraser, a headmistress of the Wanganai Girl's College, brought kiwifruit seeds back to NZ from China Yangtze area. They started to call it "Chinese gooseberries." By 1924 Hayward Wright developed the Chinese gooseberry variety, and the most common shape of it, green skin with brown fuzz, took his name.

In 1952, it was started to export kiwifruit to England. Jim MacLoughlin began to plant Chinese Gooseberries in the Bay of Plenty region in 1934, and got the successful commercial planting of Chinese gooseberries in 1937. By 1940, there were many American servicemen in New Zealand, as the war began. They liked Chinese gooseberry, Jim recognized that the export of Chinese gooseberry was the way to extend his market. Finally, in 1952 he exported the first 13 tones of Chinese gooseberries to England and in 1959 NZ Kiwifruit was exported to San Francisco, U.S.A.

There is the reason that they change the name to kiwifruit. When NZ growers started to export kiwifruit to U.S.A, they needed a phrase that could help establish the new fruit in the newly opening export market. American importer tried to change the name from "Chinese gooseberry" to "melonettes", however, it was worse and both melons and berries engaged high duties at this time. In 1959, the name Chinese gooseberry was changed to kiwifruit, named from New Zealand's national bird, the kiwi. The bird's looks just like kiwifruit: small, brown and furry. Now kiwifruit are grown in many districts on the north island of NZ and in the Nelson area on the south island.

China

It's not sure when kiwifruit started to be in cultivation in China, but it is estimated around 16C. Commercial cultivation of kiwifruit started 20 years ago. About one third of the total plantings are in Shaanxi province. In 1998 the total production of kiwifruit from China was 118 500 ton, and in 1999, 165 000 ton. Two thirds of kiwifruit in China came from Shaanxi province. Almost all the kiwifruit produced are sold within China and only small amounts are exported. Within a few years China will be producing much more kiwifruit from commercial one than any other country and this will be a significant impact on international trade in kiwifruit. At this point, we can be curious about customary rights of kiwifruits between China and New Zealand. According to the National Business Review, The Chinese spokesman called the kiwifruit a "crystallization of the profound friendship between two people," and made no mention of customary rights.(21 May 2004)

The Second Largest Production Country

New Zealand controls 28% of world trade in kiwifruit through Zespri, but is the second largest production country, after Italy. From this point of time, I'd like mention about a crisis in 1990s. It would be explain well why New Zealand, which was the strongest leader in world kiwifruit production until the mid 1980s, became the second

Certain factors within the kiwifruit industry appeared in the mid 1980s. One of factor was the emergence of strong competitor like Italy, France, Japan and the USA. This increased production led to a decline of kiwifruit prices between 1982 and 1988.

The crisis was about chemical residues in kiwifruit in an ostensible reason, but the basic factor was the relative market force of New Zealand and Italy as kiwifruit producers. However, New Zealand's dominance was alarmed by a sudden rise of kiwifruit plantings in Europe, so that by 1988 the total EC production of kiwifruit surpassed the New Zealand one. This expansion, supported by EC incentive grants strongly, made Italy the country that most quickly adopted kiwifruit as an alternative crop to fruit and wine production. This advance resulted in Italy which had a sudden rise in production levels in 1989s, and this sudden rise in Italian production made NZ being surpassed by Italia as the world's biggest kiwifruit producer in 1989. And also at this time, Italy surpassed France as the most important kiwifruit producer within the EC, and was exporting a majority of its crop to other EC counties.

Zespri

The New Zealand Kiwifruit Marketing Licensing Authority was created in 1977, and this developed to the New Zealand Kiwifruit Marketing Board(NZKMB) in 1988. In1997, The NZKMB seperated its regulatory and commercial functions. NZKMB bacamd Kiwifruit New Zealand with responsability for statutory fuctions, and "Zespri" brand was created and operated 100% grower-owned commercial marketing company,it is a well known kiwifruit brand in Korea as well as global market. In 1999, Zespri opened Zespri Gold kiwifruit(also known as Hort16A) to the market, and Hayward variety renamed as Zespri Green kiwifruit.

Organic kiwifruit Organic food is defined usually as a system by producers work within the land's capabilities to keep animals and crops in peak condition. Organic produce is grown without the use of artificial fertilizers, herbicides, pesticides, growth regulators, antibiotics, hormone stimulants, or intensive livestock systems for organic vegetables and fruit, the term refers to use of natural manure based fertilizers.In the 1990s production of organic kiwifruit has grown rapidly in NZ, and constituted almost 2% of the total crop in 1999. Japan is NZ's largest market accounting for 47.2% of total organic sales, Europe 32.5%, Australia 5.3%, and US 3.8%. Markets for organic produce are probably strongest in Japan and Europe. Of significance is the increasing reliance of NZ in Japan as the key export market for organic produce. Europe is considered to be the world's largest consumer of organic products, and so is the biggest potential market for organic products. There are demands that the rapidly growing trend towards organic kiwifruit: consumer concerns for the environment, consumer desire to be healthy and young, and concerns for food safety. Some growers don't like spraying with conventional pesticides. Many kiwifruit growers live on their orchards and don't like spraying pesticides around their own houses. In highly populated areas, organic sprays are likely to be more suitable to neighbors. In addition, a bud-breaking chemical used by most non-organic growers is controversial because of its toxicity and visibility.

Year Number of Organic Trays Produced * Organic Production as % of Total Price - Organic (NZ$/tray) Organic Price as % of Conventional Price [Table 1. Production and Price - Organic Kiwifruit, 1991-1998 Source: FAS online ] The organic premium was 42% for organic fruit which averaged NZ$9.20 per tray compared to NZ$6.48 per tray for Green kiwifruit. The data for the 1990s indicate the organic premium has ranged from a low of 27% to a high of 89% over the period.

Factors Limiting Organic Growth In 2004 the trend of Organic kiwifruit is weakening. Customers are not willing to pay more for organic kiwifruit, it may bring that the growers become less willing to produce organic kiwifruit. Many growers already have returned to non-organic production. There are factors limiting organic kiwifruit growth. Getting into the organic market is not immediate. It takes at least three years to accept as a certified organic product, because the land has to be purified from chemicals. The organic industry has suffered from the problems of quality assurance, product recognition, consumer confusion over logos, trademarks, and certification. Industry development is also affected by lack of market information and market access impediments. We need keep watching it whether organic kiwi industry will grow in spite of these impediments.

.

Gold Kiwifruit There was big growth of Zespri gold kiwi during the early 2000s. In the late 1970's, NZ kiwifruit growers started to experiment with golden kiwifruit which seeds were imported from China.In 1992, this efforts came to success and resulted in Gold kiwifruit.In 1998, 4000 trays of Gold kiwifruit were exported, each year since then, the world kiwifruit growers have planted and harvested more GOLD Kiwifruit. Zespri gold Kiwifruit is still grown commercially only.

![]() Expanding world production

Expanding world production

New Zealand Kiwifruit Marketing Board(NZKMB) is considering the idea of year- round marketing kiwifruit under the "Zespri". The idea is to control sales channels and to run 12 month promotional programs. To supply Kiwifruit throughout the year, NZ in the Southern Hemisphere is expanding a cultivation contract with Korea, U.S. Japan, and Italy which are in Northern hemisphere. Last year, Zespri has already made contract with Korea growers, Zespri Gold from Korea will come on the market from 2005.

Here is the specific example to expand market. On July 21 ,1999 the California Kiwifruit Commission (CKC) and Kiwifruit New Zealand (KNZ,operating name of New Zealand Kiwifruit Marketing Board) announced an agreement to cooerate with each other to withdraw the eight-year-old anti dumping-duty order against New Zealand kiwifruit. In addition, the two organizations agreed to pool funds to conduct market promotion efforts designed to build a year-round kiwifruit market in the United States. Under the agreement, KNZ will contribute $150,000 over three years for joint promotional activities to run in the fall months. The CKC will lead the new campaign, which will stand apart from both industries existing promotional programs. New Zealand supplies the U.S. market during the spring and summer while U.S. producers market during the fall and winter. The 1998 U.S. kiwifruit crop was valued at over $24 million and imports from new Zealand totaled over $11 million.

![]() The Future

The Future

New Zealanders might regard the name of Kiwi as their indentity and deem absolutely of that kiwifruit is from their own land, although they did not protect kiwifruit. As we see, however, New Zealand has been the second production country which took one step backward behind Italy since 1990s, China kiwifruit industry is growing dramatically. NZ have to confirm their location in the rapidly changing situations. In a couple of years, China can overtake New Zealand with the huge land and perfect environmental conditions. China would stand as a competitor like Italy did. It is only the time problem. As a main actor who developed the kiwifruit industry, NZ should think about potential disputes among co-workers. As I mentioned, NZ is operating Year-Round Marketing, It means NZ do not seem to protect their kiwifruit, they more fucus on buying and selling it, wherever it is coming from. I think this concept made NZ hard to insist intellectual property as Geographical indication, because it would require kiwifruit from other countries outside the 7 month New Zealand season. "Zespri" brand could not have country of origin designation. The only way NZ insist their intellectual property is thru "Zespri" as a trademark.

3. Related

Cases

- Baiju

Case China¡¯s alcohol industry and difficulties

this industry may encounter as China liberalizes its trade policies

- Apple Case

Apple Imports in Japan

- Applemx US apples imports

- Cherry U.S.

Cherry Exports to Japan

- AvocadoMEXICO-U.S. Avocado Trade Dispute

- Orange The impact of economic problem caused by globalization among U.S. and Brazil Orange

- Banana Banana industry in Costa Rica

4. Author and Date:

Shinyoung Yun, June , 2004

II. Legal

Clusters

II. Legal

Clusters

5. Discourse and Status: Agreement and Incomplete

6. Forum and Scope: WTO and Multilateral

7. Decision Breadth: 1

8. Legal Standing: Law

Multilateral rules for agricultural trade were developed during the 1986-93 Uruguay Round of trade negotiations under the GATT(General Agreement on Tariffs and Trade). The Uruguay Round negotiations resulted in several new WTO agreements which were launched in early 2000 and includes specific commitments to improve market access and reduce trade-distorting subsidies in agriculture by WTO members. The agricultural negotiations were wrapped into "Doha Development Agenda" at the 4th WTO ministerial Meeting at Doha, Qatar, in November 2001. Agricultural and agricultural exports are vital further agricultural reform is crucial to New Zealand.

III. Geographic Clusters

III. Geographic Clusters

9. Geographic Locations

a. Geographic Domain: Pacific

b. Geographic Site: South Pacific

c. Geographic Impact: New Zealand

Kiwifruit production is concentrated in the Bay of Plenty, which makes up over 80%. The geography of the Bay of Plenty is equipped to concentrated horticultural production. It is sunny and covered from the predominantly westerly wind by a mountain range, and it is the largest lowland area in the north island. The climate involves warm summers typically and mild winters with rainfall averaging between 1000-1500 mm per annum.

.

.

10. Sub-National Factors: Yes

11. Type of Habitat: Temperate

IV. Trade

Clusters

IV. Trade

Clusters

12. Type of Measure: Intellectual property

13. Direct v. Indirect Impacts: Yes

14. Relation of Trade Measure to Environmental Impact

a. Directly Related to Product: Yes

b. Indirectly Related to Product: No

c. Not Related to Product: No

d. Related to Process: Yes, Culture

15. Trade Product Identification: Kiwifruit

16. Economic Data

Kiwifruit is

New Zealand's biggest horticultural export product. The value of fresh exports

increased by 63% between June 1887 and 2002, from a value of NZ $ 377 million

to NZ$ 616 million. In 1999, kiwifruit production was 40,000 ton less than in

1998. The reason is the bad forecast condition in the Bay of Plenty region where

80% of kiwifruit is grown. Acceptable weather condition for 'Hayward' kiwifruit

is that winter temperatures below 45¡ÆF (7-C) for 600-700 hours and a frost-free

season of 225-240 days. All young vines and some old bearing vines are killed

Temperatures below 10¡ÆF (-12¡ÆC) in mid-winter, the crop is ruined in frost

below 30¡ÆF (-1.0¡ÆC) in spring. In 1999 New Zealand has severe frosts in September

and heavy rainfall in December. It also affected on the vines which were grafted

to Zespri Gold Kiwifruit, and resulted less production in 1999. However, in

2002, the success of Zespri Gold, which was about 18,000 MT, brought 42,000

MT of production more than in 2001. [see table2]

[Table 2. NZ kiwifruit economic and trade data. Source: FAO Attache Reports kiwifruit annual 1994-2004]

| Year | production | imports |

totalsupply/ Distribution |

exports |

Domestic consumption |

|

1994/1995 |

250,000 |

0 |

250,000 |

220,000 |

30,000 |

|

1995/1996 |

235,000 |

0 |

235,000 |

205,000 |

30,000 |

|

1996/1997 |

250,000 |

70 |

250,070 |

223,339 |

26,731 |

|

1997/1998 |

250,000 |

70 |

250,070 |

223,339 |

26,731 |

|

1998/1999 |

210,000 |

400 |

210,400 |

196,393 |

14,007 |

|

1999/2000 |

244,800 |

150 |

244,950 |

228,312 |

16,638 |

|

2000/2001 |

229,068 |

150 |

229,218 |

213,033 |

16,185 |

|

2001/2002 |

271,000 |

150 |

271,150 |

247,000 |

24,150 |

|

2002/2003 |

247,320 |

150 |

247,470 |

227,530 |

19,950 |

|

2003/2004 |

245,000 |

150 |

245,150 |

225,000 |

20,150 |

|

2004/2005 (estimate) |

270,000 |

500 |

270,500 |

252,000 |

18,500 |

17. Impact of

Trade Restriction: Low

18. Industry

Sector:

Food

19. Exporters and

Importers:

New Zealand and

Many

20. Environmental

Problem Type: Culture

21. Name, Type,

and Diversity of Species

![]() V. Environment Clusters

V. Environment Clusters

Name: Actinidia diliciosa species --- Hayward, Bruno, Saanichton 12,Blake etc.

Hardy species ---Ananasnaya, 74-49, Meader, A.arguta car. cordifolia, Ken's Red, Geneva, Issai etc.

Ko;omokta species --- Krupnopladnaya, Pautske etc.

Silver Vine species etc.

Type: vine

Diversity: more than 50 species

22. Resource Impact and Effect: Low and Product

23. Urgency and Lifetime: Low

24. Substitutes:

VI. Other Factors

VI. Other Factors

25. Culture: Yes

26. Trans-Boundary Issues: No

27. Rights: No

28. Relevant Literature

Article

- Foreign Agriculture Service New Zealand kiwifruit stiation and outlook 1998-2004

- HornetNews organicExports grow rapidly

- Growing Kiwi

- Kiwifruit Actinidia deliciosa

- An overview of organic industry in New Zealand

- Recent developments in organic food production in New Zealand

- NZ Kiwifruit News New law to protect kiwifruit export monopoly

- Kiwifruit in China 1

- Kiwifruit in China 2

- Glorious trip home

- The rise of Organic Kiwifruit

- Organic costs and risks

- Organic kiwifruit

- Organic Perspective

- Organic Exports Growing Rapidly

- An Overview Of The Organic Industry In New Zealand

- Agriculture and the WTO

- Kiwifruit production May 03

Website

- Zesprikiwi Company Web Site The history of Kiwifruit

- The Royal society of New Zealand

- Hortresearch

- New Zealand Ministry of Foreign Affairs and Trade

- New Zealand News

- California Kiwifruit Commision